Portland, OR

Choices…

As an investor, you have many choices as to where to invest. Stocks, bonds, CD’s, alternative investments, real estate… the list goes on and on. As everybody knows, diversity is good, so mixing in a few of these asset classes to your overall strategy is a prudent move.

Once you’ve determined that real estate is a great asset to invest in and you’ve determined that residential real estate sounds better than either commercial or industrial real estate, now comes the fun part…

| IRON BRIDGE AT A GLANCE: | |

|---|---|

| Years in Business: | 9 |

| Borrowers: | 729 |

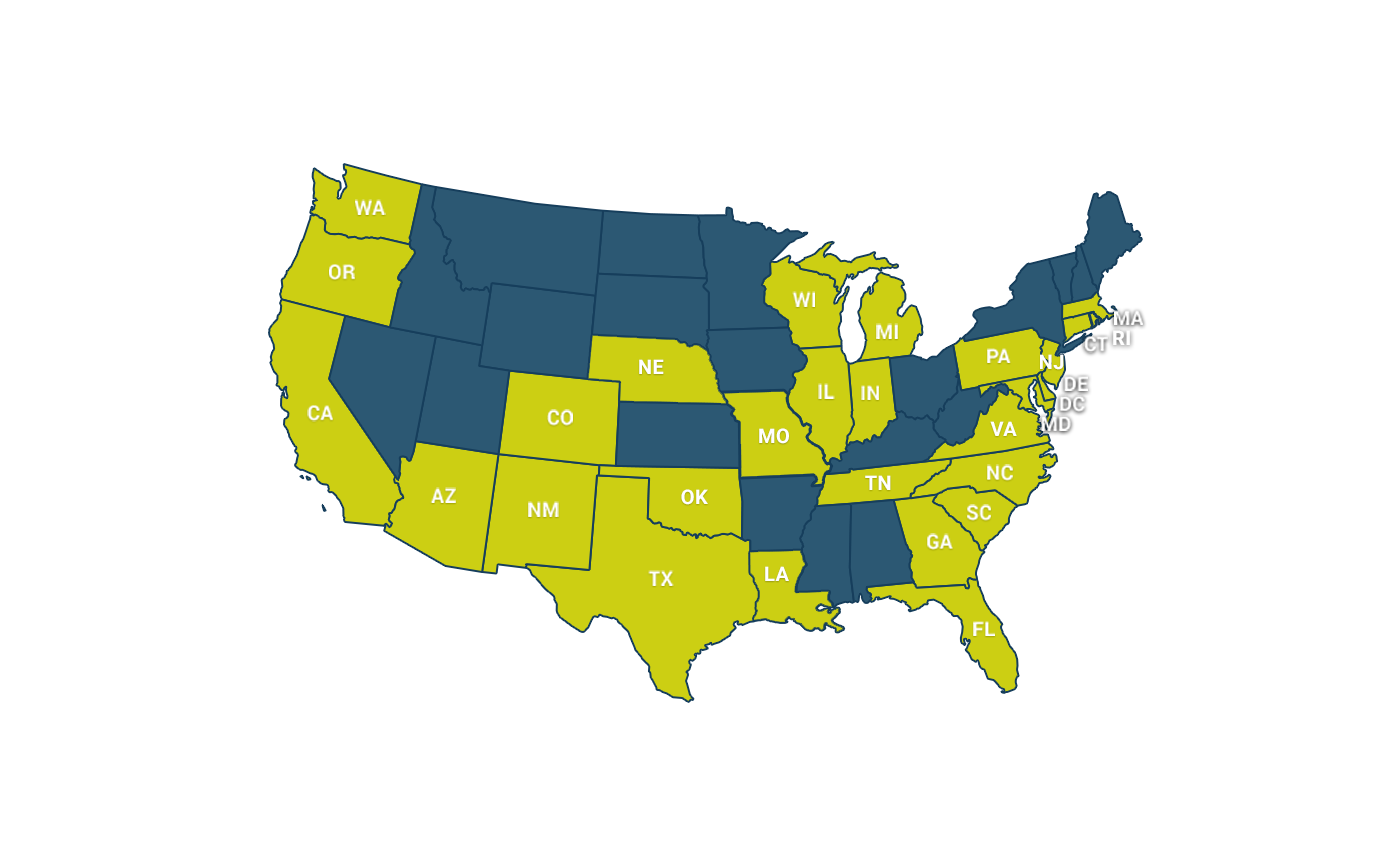

| Current States Lending In: | 29 |

| Total Projects: | 2,283 |

| Borrower Net Profits: | $98,341,497 |

How Best to Invest?

Choose an investment that meets your lifestyle

Choosing a good residential real estate investment is as much about your lifestyle as it is about the rate of return. If you want to be actively working for your investment you can be a landlord or a rehabber of a property and manage a single property, or a few of them. This takes a lot of personal time and handyman skills. And if something happens to the property (fire, flood, mold, degrading neighborhood, bad tenants) you could end up in a losing situation.

“A passive portfolio real estate investment for non-accredited investors is the rare investment that allows the vast majority of Americans the ability to invest in hundreds of properties all across the United States.”

Single Property

US Portfolio of Properties

Passive Real Estate Investment

If you don’t like the idea of having all your eggs in the single property basket, then you’re probably leaning towards more passive real estate investing. There are many options here too, but until now most required you to be an accredited investor who:

- Earns $200k per year;

- or $300k joint with your spouse;

- or have $1M net worth excluding your primary residence.

If you’re wondering, that is less than 9% of Americans. If you’re in the other 91% of Americans, there is still hope!

Accredited and Non-Accredited Investors

9% of Americans are Accredited Investors

YES— Can invest in Iron Bridge Senior Secured Demand Notes.

91% of Americans are Non-Accredited Investors

YES— Can invest in Iron Bridge Senior Secured Demand Notes.

Invest in Hundreds of Properties, Not Just One

A passive portfolio residential real estate investment for non-accredited investors is the rare investment that allows the vast majority of Americans the ability to invest in hundreds of properties all across the United States. You don’t have to pick one property that could go bad, you don’t have to be a landlord, and you can leverage all the best housing markets.

Investing in a portfolio residential real estate program like the Senior Secured Demand Note Program from Iron Bridge Lending offers all types of investors a very secure 6% rate of return and fast liquidity with 30-days notice. An investment in the Senior Secured Demand Note Program goes to work immediately earning you monthly interest, and if you reinvest the interest it compounds and effectively returns 6.17%.

“If your investing goals include diversification,

passive income, preservation of wealth,

and participating in the residential real estate sector,

an investment with a portfolio lender like Iron Bridge may be a good choice.”

If you would like to learn more about Iron Bridge’s Senior Secured Demand Notes click www.ironbridgelending.com/investors or call (503) 225-0300.

I like to invest in real estate to build and maintain a diversified portfolio. I don’t want to spend my time continually evaluating new real estate investments one-by-one. The Senior Demand Notes solve this problem because I earn interest every day and my investment is spread across a portfolio of a few hundred real estate loans located across the US.”

Iron Bridge Senior Secure Demand Notes

Portfolio Properties

US States Operating In

Real Estate Collateral

%

Interest with Compounding

Days Redeemable

Lockup or Waiting Period

DISCLOSURE: The views and opinions shared in this article are those of the author(s), and do not represent the views of Iron Bridge Lending nor are they formal recommendations. Iron Bridge does not provide tax, legal or investment advice, and this article should not be construed as such. Before making any investment, investors should consult with their own attorneys, accountants or other investment advisors.