“The essence of investment management,” said legendary investor Benjamin Graham, “is the management of risks, not the management of returns.” We agree, and also believe that investors cannot be successful over the long term if they do not understand the relationship between risk and return within the context of the efficient market theory, which generally assumes two things: (1) information is ubiquitous and (2) capital moves freely. These two assumptions are critical in understanding the drivers of asymmetrical returns, which can be defined simply as higher rates of investment return per unit of risk than the efficient market theory would suggest.

The first assumption, “information is ubiquitous,” generally means that all investors know about all investments available and have analyzed all the information available related to those investments. In the public markets (e.g., publicly-traded stocks and bonds) this assumption is often true. For example, large investment funds with billions of dollars in investment capital often employ large staffs of analysts, each dedicated to specific industries or companies. The public companies they analyze are generally required by law to disclose material information to the public in a timely manner. When new information is made available, these analysts can quickly assimilate the information and invest accordingly. These conditions make information ubiquitous in the public markets, but these conditions generally do not hold true in the private lending industry for rehab and new construction projects.

The second assumption, “capital moves freely,” generally means that investors are able and motivated to allocate capital among investment opportunities in a way that always maximizes the investment return per unit of risk. Again, in the public markets (e.g., publicly-traded stocks and bonds), this assumption is often true. For example, large investment funds are generally competing to attract investment capital by earning a superior investment return relative to their peers and are therefore motivated to reallocate investment capital in order to maximize investment returns. In addition, the public markets are generally liquid and allow these institutional investors to buy and sell quickly with minimal transactional costs. These conditions allow capital to move freely in the public markets, but these conditions generally do not exist in the private lending industry for rehab and new construction projects.

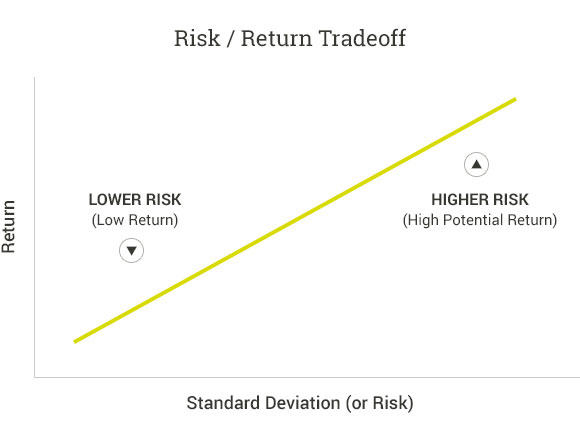

By comparison, within the private lending industry information generally is not ubiquitous and capital generally does not move freely. For example, private lenders in Florida or New Jersey may not necessarily know about lending opportunities in Oregon or California. Moreover, even if those private lenders were made aware of these lending opportunities, the private lenders may not be interested or structurally capable of evaluating and funding the loans in the timeframes required. Further, capital generally does not move freely in the private lending industry for rehab and new construction projects. For example, the largest lenders in the real estate industry are banks, which are both government regulated and structurally challenged. Government regulations often dissuade banks from pursuing certain types of profitable loans in order to comply with larger risk management overlays. The banks are also often structured in ways that make them relatively slow in analyzing and funding loans. What this means is that the private lending industry for rehab and new construction projects is fragmented and inefficient and does not comply with the efficient market theory’s assumptions of ubiquitous information flow and free movement of capital. This inefficiency provides an opportunity for participants in the private lending industry to earn asymmetrical investment returns, or, in other words, a higher rate of return per unit of risk versus public market investments as indicated in the following graph.

As a premier portfolio lender and private money partner, Iron Bridge Lending is fluent in the subtleties of private lending, such as this one. If you would like to discuss asymmetric investment returns, or other facets of the private lending market, please don’t hesitate to contact us.

Iron Bridge Lending is “testing the waters” to gauge market demand from potential investors for a proposed offering of its Senior Secured Notes under Tier II of Regulation A. The foregoing includes information about the proposed offering. This information is subject to change at any time. An Offering Statement on Form 1-A regarding the proposed securities offering has not yet been filed with the Securities and Exchange Commission (the “SEC”). No money or other consideration is currently being solicited, and if sent in response, will not be accepted. No offer to buy the securities can be accepted and no part of the purchase price can be received until an Offering Statement is qualified by the SEC, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time before notice of its acceptance given after the qualification date. An indication of interest made by a prospective investor involves no obligation or commitment of any kind. No offer to sell any securities, and no solicitation of an offer to buy any securities, is being made in any jurisdiction in which such offer, sale or solicitation would not be permitted by law.