Portland, OR

Iron Bridge recently opened up a new investment option for both accredited and non-accredited investors– Senior Secured Demand Notes.

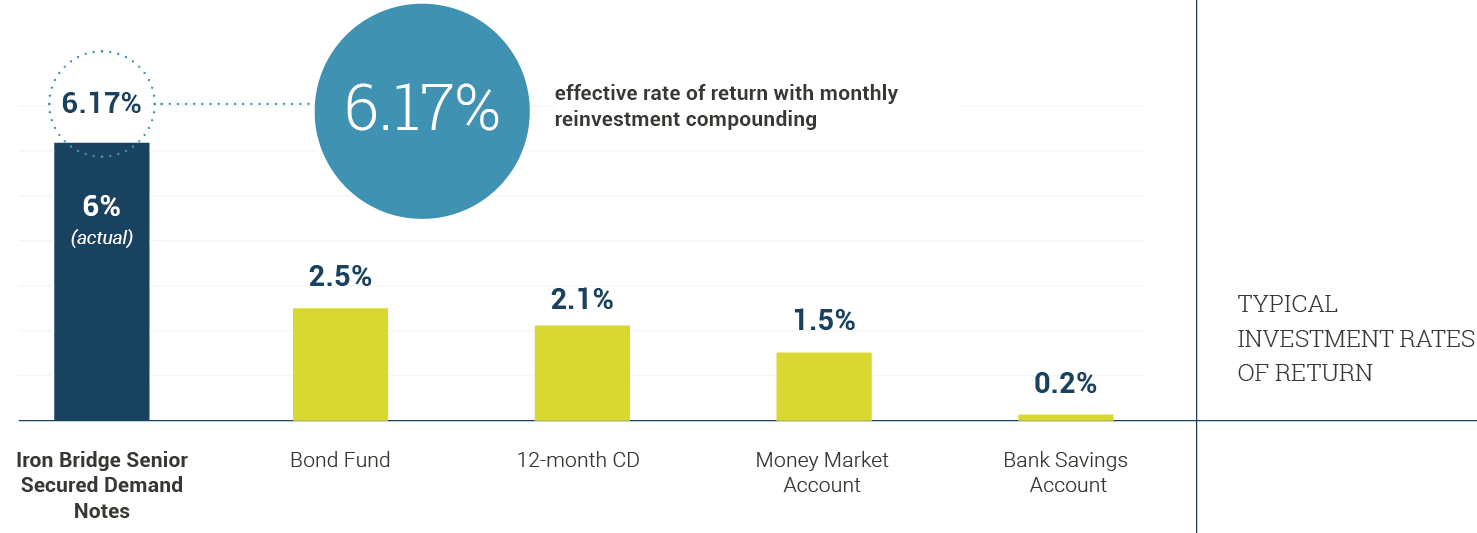

Senior Notes return an attractive 6.17% effective interest rate with compounding and are redeemable at par with a 30-day notice.

| IRON BRIDGE AT A GLANCE: | |

|---|---|

| Years in Business: | 9 |

| Borrowers: | 729 |

| Current States Lending In: | 29 |

| Total Projects: | 2,283 |

| Borrower Net Profits: | $98,341,497 |

Three Investment Stacks

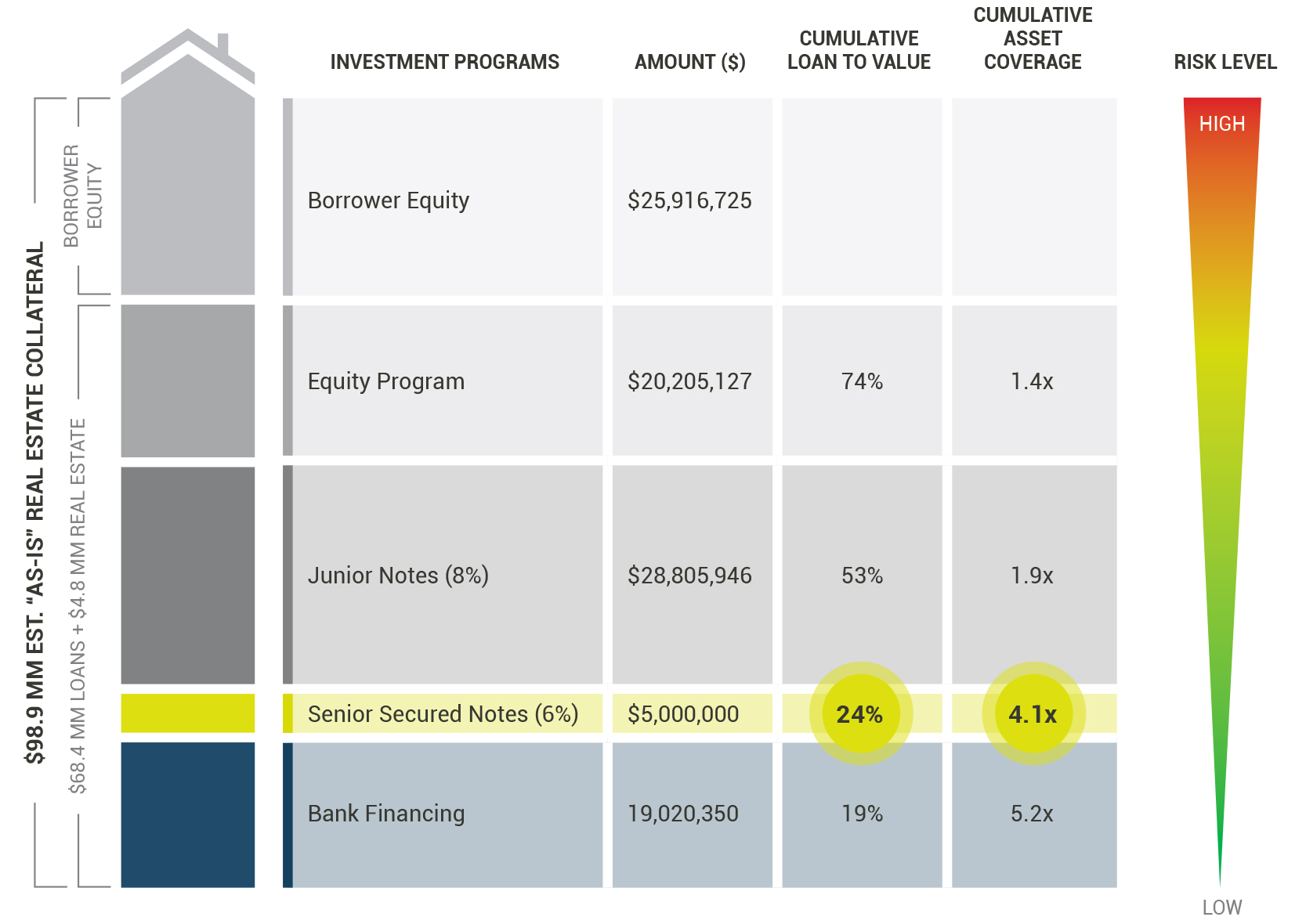

Since early 2018, Iron Bridge’s capital structure is comprised of three investment programs, the Junior Notes, Senior Notes, and the Equity Program. Each offers investors different investment options relative to risk, return, and liquidity.

The Senior Notes, introduced during the first quarter of 2018, are the third and newest investment program designed to provide investors the highest level of security and liquidity compared to the Company’s Junior Notes and Equity Program. Senior Notes are currently the only program open to new investors.

Iron Bridge Senior Notes

The Senior Notes help Iron Bridge lower its blended cost of capital, which allows the Company to offer lower priced loans and attract the highest quality portfolio borrowers. This secures the Notes with the best-of-the-best properties and borrowers, which typically translates to great properties that pay off on time with very low default rates or problems.

Senior Notes have a perpetual maturity and are redeemable at par with a 30-day notice to Iron Bridge, providing investors liquidity while minimizing reinvestment risk and interest rate risk.

In addition, Senior Noteholders can add to their Senior Notes or withdraw from their Senior Notes intra-month, offering investors the ability to earn interest from the day Iron Bridge receives the funds through the day the funds are returned to the investor. It’s a great way for investors to earn an attractive rate of return on capital that might otherwise be sitting in the bank earning nearly nothing.

Rate of Return

The Senior Notes are senior in security interest to the Company’s existing Junior Notes and Equity Program capital, and subordinate to the Company’s Bank Borrowings or any replacement or addition to such borrowings.

Specifically, Equity Program investors share in the profits of Iron Bridge but are only protected by the value of the real estate collateral securing the Company’s loan portfolio and are first at risk of capital loss should the value of the real estate collateral be insufficient to repay the loan portfolio.

Junior Noteholders earn an 8% interest rate and are protected by the real estate collateral securing the loan portfolio and further protected by over $20 million in Equity Program capital, which would have to be charged off before a Junior Noteholder would lose any of their principal investment.

The Senior Noteholders earn a 6% interest rate and are protected by the real estate collateral, over $20 million in Equity Program capital and further protected by over $28 million in Junior Notes, which would all have to be charged off prior to a Senior Noteholder losing any of their principal investment.

As of December 31, 2017, the pro forma interest coverage, “as-is” loan-to-value and “as-is” asset coverage would have been 7.1 times, 24% and 4.1 times, respectively. See the Company’s most recent quarterly report for more information.

I like to invest in real estate to build and maintain a diversified portfolio. I don’t want to spend my time continually evaluating new real estate investments one-by-one. The Senior Demand Notes solve this problem because I earn interest every day and my investment is spread across a portfolio of over 200 real estate loans located across 29 states.”

Iron Bridge Senior Secure Demand Notes

Portfolio Properties

US States Operating In

Real Estate Collateral

%