$600 Million Dollars!

Portland, Oregon

August 5, 2018

Iron Bridge Lending surpasses a major milestone — over $600,000,000 in total loan origination. Helping Iron Bridge get there are over 729 fantastic borrowers with 2,283 projects all across the United States.

| IRON BRIDGE AT A GLANCE: | |

|---|---|

| Years in Business: | 9 |

| Borrowers: | 729 |

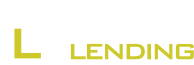

| Current States Lending In: | 29 |

| Total Projects: | 2,283 |

| Borrower Net Profits: | $98,341,497 |

Growth Nationwide

Iron Bridge Lending was established in 2009 and excels at developing innovative real estate financing solutions tailored to the specific needs of each borrower. Our commercial-purpose loans have provided funds for the acquisition and construction of 2,283 single-family or multi-family rehab or new-build projects. Over $98 Million in net profits have been generated for 729 borrowers to date.

Iron Bridge has grown from a regional Pacific Northwest private lending firm into a nationwide lending leader. Iron Bridge currently lends in 29 states coast-to-coast and is expanding thoughtfully into other states going forward.

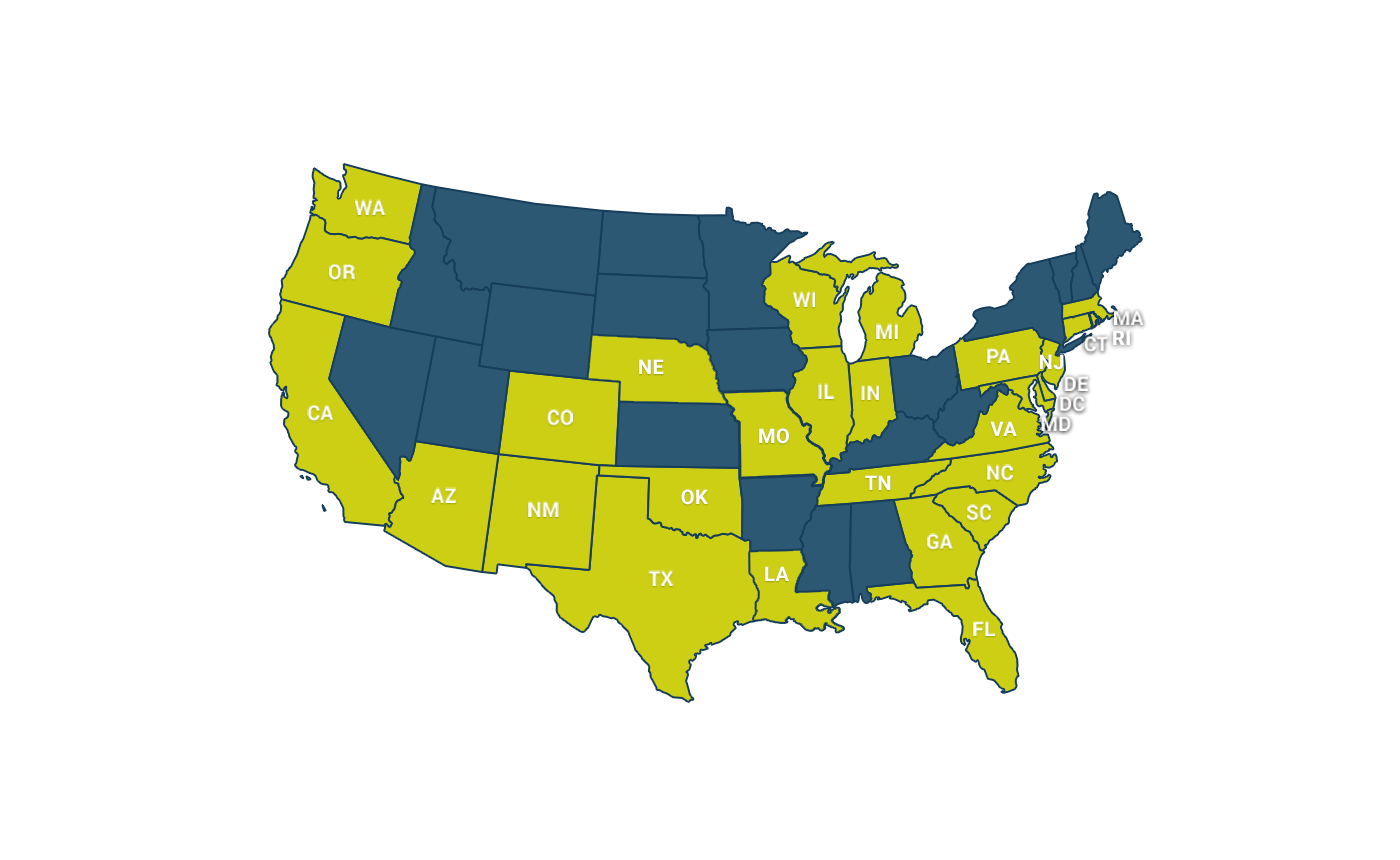

Lending Portfolio

Iron Bridge lends mainly on single-family fix-n-flip projects (86%), while some new construction (8%) and multi-family rehabs (5%) round out the portfolio. Loans typically originate under $1.5M, with the majority of loans in the range of $100k – $500k.

“This most recent $100 MIllion in Loan Originations only took about 10 months to achieve– A new record for Iron Bridge.”

— Dick Heydet, Director of Marketing and Client Relations, Iron Bridge Lending

Since inception, Iron Bridge Lending has generated $98,341,497 in net profits for our borrowers and completed 2,283 projects as the funding partner.

Unique Advantage

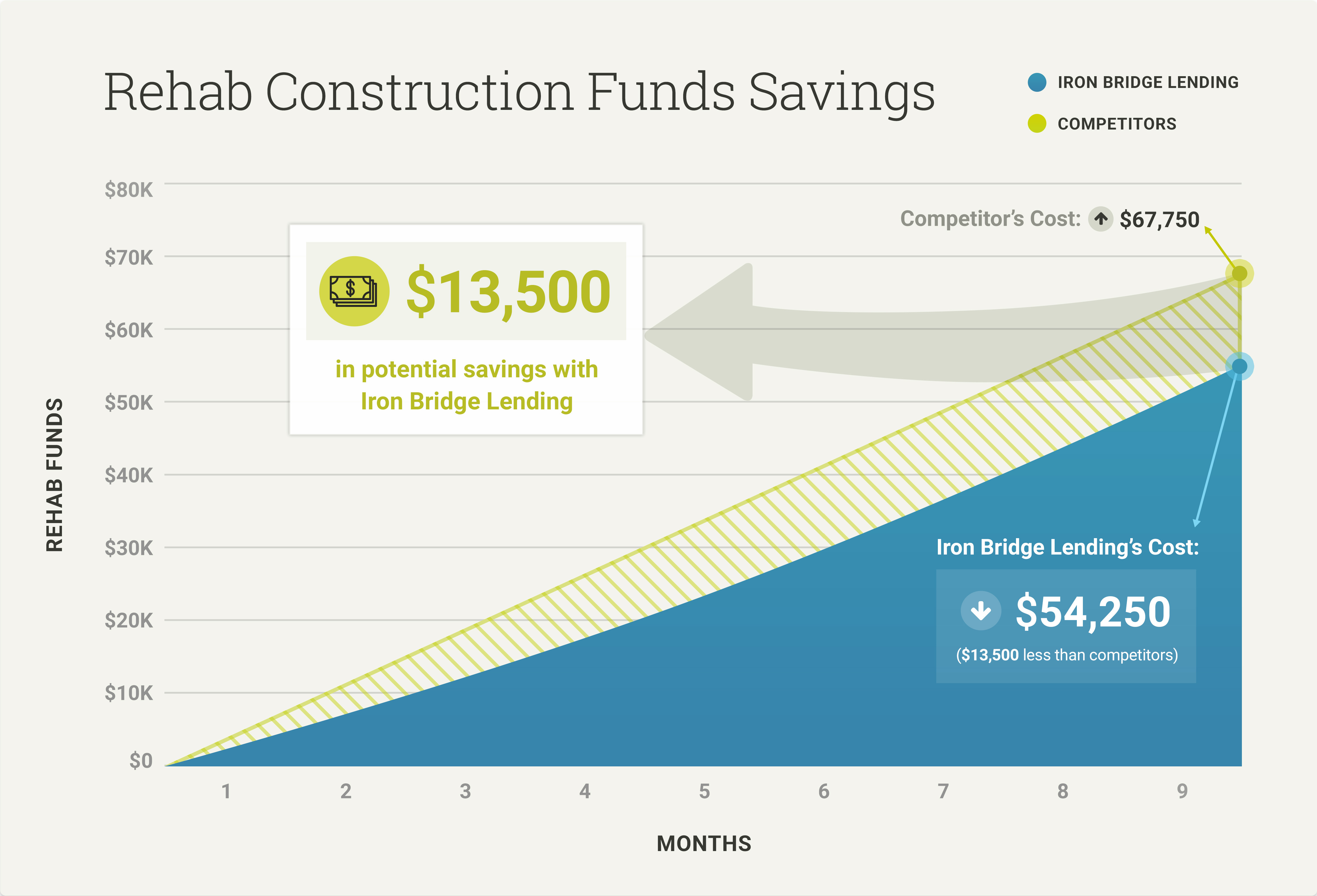

One of the distinct advantages borrowers cite for the company’s success is the unique way that Iron Bridge disperses construction funds. Rather than charge interest on the entire amount of construction funds, Iron Bridge only charges interest on funds as they are drawn. This translates to potentially thousands of dollars in savings on each project. See more details on this program here.

Conclusion

The real estate finance industry is in the early stages of a major transformation, driven by technology and new securities laws, that is creating significant value for borrowers, investors, and companies. Iron Bridge continues to be an industry leader and innovator, providing borrowers with lower interest rates and better service, and investors with superior risk-adjusted returns. Our team is passionate about creating value for our clients and building lasting relationships, while effectively managing risk.

If you would like to learn more about how to become a borrower with Iron Bridge Lending feel free to email [email protected] or call (503) 225-0300.

Iron Bridge is easy and professional to work with. They do what they say they are going to do and make the process of funding, draws, and payoff very simple. Give them a shot, if you compare all that they have to offer, you will not find a better hard money lender”

Why Iron Bridge Lending?

In-House Underwriting

Iron Bridge has complete control of loan approvals and can assure funding upon project approval. We are not a broker.

Construction Draw Program

Only pay interest on construction funds as you draw them, rather than all at once.

Direct Access to Decision Makers

Simplifies all communication and leads to fast, thoughtful decisions so your project can move quickly.

Online Dashboard

Our online portal allows easy access to your existing loans, draw requests, payment history and more.

In-House Draw Processing

Our goal is to disburse funds for each draw request in less than 7 days from the date a complete draw request has been received.

Cross Collateralization Program

Gives qualified borrowers the financing they need to secure their next project while they finish up the first.