Different from most other lenders, Iron Bridge only calculates interest on disbursed construction funds. Unutilized construction balances remain untouched by interest until drawn upon, which can save Iron Bridge’s borrowers thousands.

Iron Bridge Lending is uniquely positioned to provide this service to its borrowers because the company is a $75 million portfolio lender that originates, funds and services its loans from origination through payoff.

By effectively managing the servicing side of the loan, Iron Bridge earmarks these funds internally and keeps capital in-house until disbursement. This means no carrying cost is passed along to Iron Bridge borrowers.

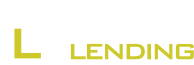

Compare the Interest Expense Savings of the Iron Bridge Lending Construction Loan program:

The chart above compares a larger value-add construction loan from Iron Bridge with the same loan from another lender who charges interest on the full amount of the construction loan from Day 1. In this example we assume the following:

- Principal: $750,000 ($450,000 acquisition + $300,000 construction funds)

- Interest Rate: 12%

- Maturity: 9 months

= $13,500 potential savings with Iron Bridge Lending, or 2.4% APR.

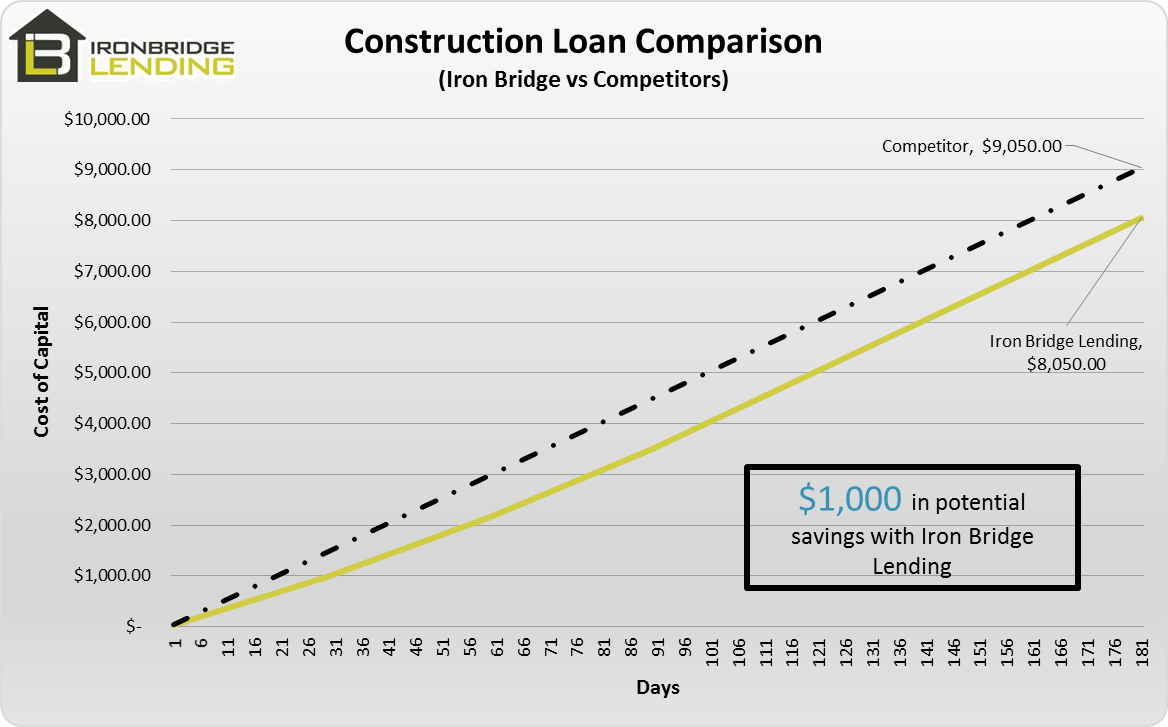

The chart above compares a relatively small fix & flip construction loan from Iron Bridge with the same loan from another lender who charges interest on the full amount of the construction loan from Day 1. In this example we assume the following:

- Principal: $150,000 ($100,000 acquisition + $50,000 construction funds)

- Interest Rate: 12%

- Maturity: 6 months

= $1,000 potential savings with Iron Bridge Lending, or 1.33% APR.

Also– No junk fees!

Absent from the analysis above are the additional junk fees charged by most other lenders. These junk fees can include document preparation fees, legal fees, and appraisal fees. Iron Bridge only charges interest rate and points, providing borrowers with additional savings.

When these financing costs are considered, the benefit of using Iron Bridge is even greater.

Contact Iron Bridge Lending soon to see how much you could save on your next Hard Money Rehab, Fix & Flip or New Construction Loan!